The Importance of Analyzing Brent Crude Trends

Understanding Brent crude oil trends is essential for investors, companies, and policymakers alike. Its price movements can provide early indicators of economic conditions, supply and demand changes, and even geopolitical tensions. By leveraging Fintech analytics, users can access real-time and historical data, perform trend analysis, and forecast price changes based on data-driven insights.

Impact of Brent Crude on Global Markets

Brent crude oil prices are a benchmark for oil pricing worldwide, affecting the costs of goods and services in numerous sectors. Changes in these prices can lead to fluctuations in production costs, fuel prices, and inflation rates. Fintech analytics platforms offer tools to analyze how these changes impact industries globally, helping companies and governments better plan for price shifts. For example, significant price increases in Brent crude could signal potential rises in fuel prices, prompting businesses to reassess their logistics and operating costs.

Benefits of Using Fintech Analytics for Brent Crude Analysis

Fintech analytics platforms have revolutionized how data is processed and interpreted, making them an asset for analyzing commodities like Brent crude. These tools offer several benefits, including real-time data access, enhanced forecasting models, and visualizations that help users understand complex data. By utilizing these features, investors and analysts can gain a more nuanced understanding of crude oil trends, enabling them to make decisions with greater confidence.

Key Metrics in FintechZoom’s Brent Crude Analytics

Fintech analytics platforms like FintechZoom track various metrics that help users analyze Brent crude trends. These metrics offer valuable insights into market conditions and can assist in forecasting price movements, making it easier for businesses and investors to make data-driven decisions.

Real-Time Price Monitoring

One of the most valuable features of FintechZoom’s Brent crude analytics is real-time price monitoring. By accessing real-time data, users can track price changes as they happen, enabling them to respond swiftly to market shifts. Real-time data is especially critical in times of high volatility, where even slight price movements can lead to substantial impacts. This monitoring capability supports better decision-making for those involved in trading and investment, providing them with an edge in responding to fast-changing conditions.

Historical Trend Analysis

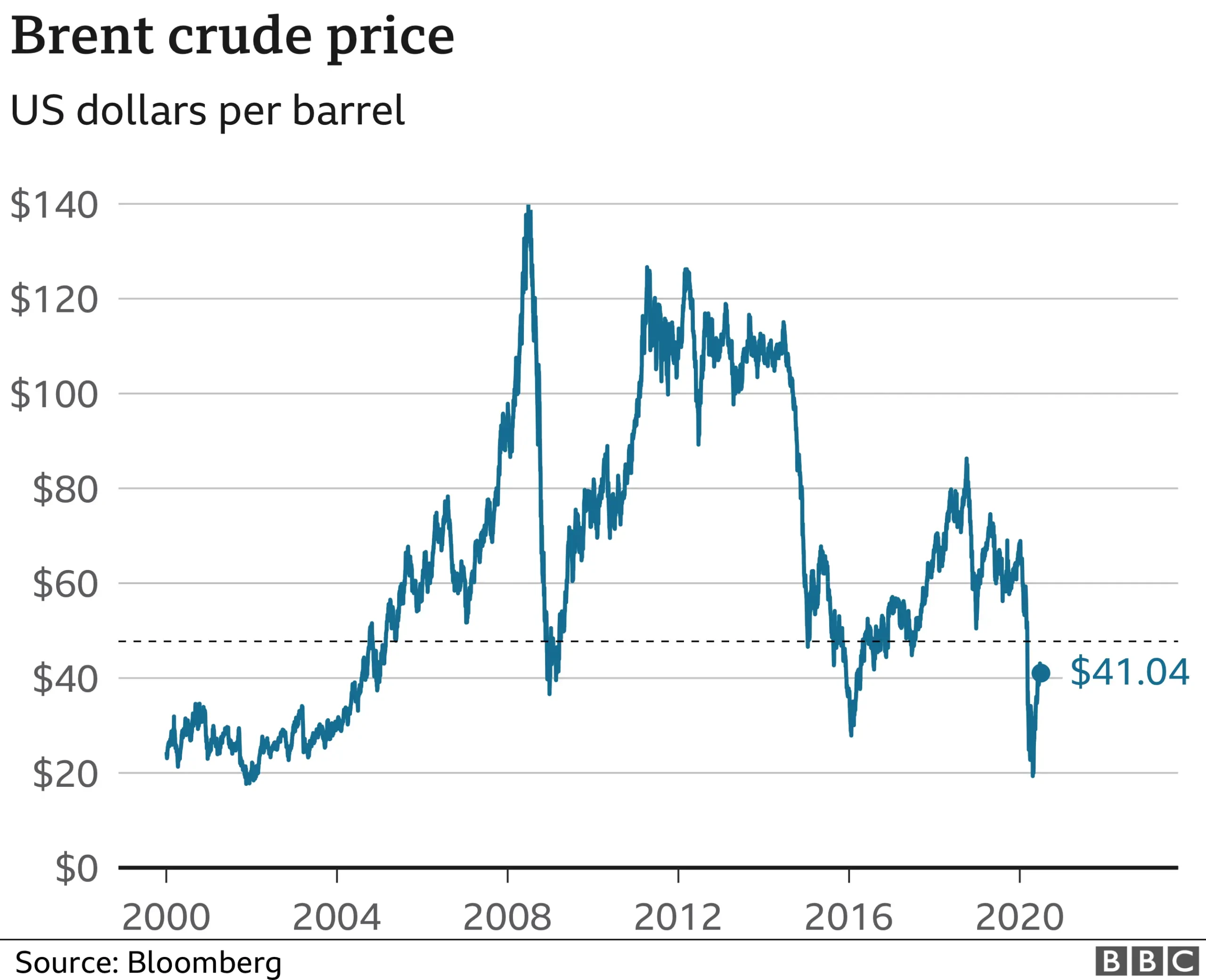

In addition to real-time monitoring, FintechZoom’s analytics tools allow users to examine historical Brent crude trends. Historical data is essential for understanding price cycles, seasonal trends, and the effects of past geopolitical events on oil prices. By analyzing past trends, users can gain insights into potential future movements, as historical patterns often influence present market conditions. This metric is beneficial for companies that want to hedge against price volatility or assess risk in their operations.

Utilizing FintechZoom Brent Crude Analytics for Forecasting

Forecasting Brent crude prices requires a combination of historical data, real-time monitoring, and advanced statistical models. FintechZoom’s tools are designed to incorporate these elements, providing users with forecasting models that can project potential price movements.

Predictive Modeling Techniques

FintechZoom’s Brent crude analytics leverage predictive modeling techniques to help forecast price trends. These models utilize machine learning algorithms and historical data to predict price movements based on previous market behavior. For instance, predictive models can assess how seasonal demand or geopolitical developments might influence Brent crude prices, offering users a data-backed projection for future changes. These forecasts are particularly useful for long-term planning, enabling businesses and investors to prepare for potential shifts in the energy market.

Scenario Analysis

Scenario analysis is another powerful feature within FintechZoom’s Brent crude analytics suite. This tool allows users to simulate different economic, geopolitical, and supply-demand scenarios to observe their potential impacts on Brent crude prices. By considering various scenarios, users can prepare for a range of outcomes, improving risk management and helping to strategize for uncertainty. This function is especially relevant in times of geopolitical instability, where sudden changes can create significant price volatility.

How External Factors Influence Brent Crude Trends

Brent crude prices are sensitive to numerous external factors, making it essential to analyze these influences through fintech analytics. FintechZoom’s analytics suite incorporates these external factors, enabling a well-rounded view of the forces shaping Brent crude prices.

Geopolitical Tensions

Geopolitical events often have immediate and substantial impacts on Brent crude prices. Situations like conflicts in oil-producing regions or trade sanctions can disrupt supply chains, causing prices to spike. FintechZoom’s Brent crude analytics allow users to monitor such developments and analyze how they might affect prices. By staying informed of geopolitical changes, investors and businesses can adjust their strategies to manage the risks associated with price volatility.

Supply and Demand Shifts

Supply and demand play a crucial role in determining Brent crude prices. Factors like production levels from OPEC countries, shifts in energy demand, and global economic growth can significantly affect the supply-demand balance. FintechZoom’s tools help track these shifts by providing real-time data and analytics on supply and demand indicators, such as inventory levels and production quotas. Understanding these dynamics allows users to anticipate price fluctuations, positioning them to make informed decisions on timing their trades or adjusting budgets.

Applications of FintechZoom Brent Crude Analytics Across Industries

Brent crude trends affect numerous industries, from transportation to manufacturing and financial markets. FintechZoom’s analytics can be applied across various sectors to assist in planning, budgeting, and investment strategies based on Brent crude price insights.

Financial Market Analysis

In financial markets, Brent crude trends are closely monitored, as price changes can impact stock values, currencies, and inflation rates. FintechZoom’s analytics tools assist investors in tracking Brent crude’s impact on financial instruments, such as stocks of oil companies or currencies of oil-dependent nations. By analyzing the interplay between Brent crude prices and financial markets, investors can make better-informed decisions regarding their portfolios.

Strategic Planning for Energy-Intensive Industries

Industries that rely heavily on energy, such as transportation and manufacturing, are significantly affected by Brent crude price trends. FintechZoom’s Brent crude analytics provide these industries with insights that support strategic planning. For instance, transportation companies can forecast fuel expenses and adjust their budgets accordingly, while manufacturers can estimate production costs. By factoring in Brent crude trends, these industries can enhance operational efficiency and reduce financial risk related to energy price volatility.

Future Developments in FintechZoom’s Brent Crude Analytics

As fintech continues to evolve, so too will the tools available for analyzing commodities like Brent crude. FintechZoom is at the forefront of these advancements, continually enhancing its analytics features to provide users with deeper insights and more robust forecasting capabilities.

AI-Driven Analytics Enhancements

Artificial intelligence (AI) is set to play a transformative role in financial analytics. FintechZoom is exploring AI-driven analytics to improve the accuracy of Brent crude price forecasts. With AI, the platform can process vast amounts of data more efficiently, identifying patterns and making predictions with greater precision. This development could provide even more reliable forecasting, helping users stay ahead of market changes.

Integration with Broader Economic Indicators

FintechZoom is also focusing on integrating broader economic indicators into its Brent crude analytics. By including factors like GDP growth rates, inflation, and currency fluctuations, the platform can offer a more comprehensive view of the factors influencing Brent crude prices. This holistic approach will enhance users’ ability to understand how Brent crude trends are intertwined with the global economy, leading to more informed decisions.

The Value of FintechZoom’s Brent Crude Analytics

FintechZoom’s Brent crude analytics offer valuable tools for understanding and navigating the complexities of the oil market. Through real-time data, predictive modeling, and scenario analysis, users gain a thorough perspective on the factors driving Brent crude prices. The insights provided by FintechZoom’s analytics empower investors, businesses, and policymakers to make data-driven decisions that account for current and future market conditions. As FintechZoom continues to innovate and incorporate advanced analytics, its Brent crude tools will remain a crucial resource for anyone involved in the global energy market.